Buyers are now finding it considerably tougher to obtain loans from the banks, and real estate agents around the country are beginning to feel the impact of the credit crackdown at quiet auctions and open homes.

With the final report into the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry due to be submitted on 1 February 2019, scrutiny applied to banks’ behaviour, specifically regarding their lending practices, has already kicked many into action well before the release of the final findings and recommendations.

Westpac (+0.14 to 5.38), Commonwealth Bank (+0.15 to 5.37) and ANZ (+0.16 to 5.36) have all raised their variable mortgage interest rates, with the wider financial services industry put on notice and now ensuring they obey responsible lending rules.

“Absolutely there’s a credit crunch across the country,” said Malcolm Gunning, the president of the Real Estate Institute of Australia.

“The royal commission has really uncovered a few problems in the lending policies of the banks, so the banks have reacted and taken a more conservative approach.”

Banks are now – more than ever – going through loan applications with a fine-toothed comb, resulting in many buyers finding it too difficult to obtain finance and choosing instead to window shop rather than commit to purchasing property.

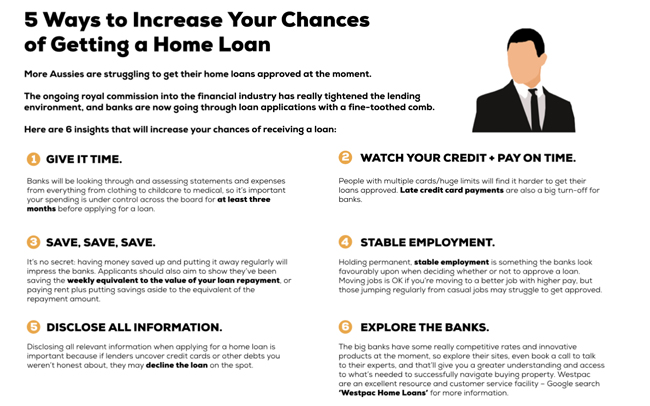

If you’re in the real estate industry and are currently experiencing this exact problem, here are some tips you can offer your buyers to put them in the best possible position to successfully obtain a home loan and hopefully convince them to buy that property.

We’ve also included a free downloadable tip sheet you can share or send to your buyers at the bottom of the page!

tougher for buyers and real estate agents, alike

1. Give it time

It’s wise to assess for applicants to assess spending habits and getting everything in order to make sure they can get their loan approved before they start looking.

Banks will be looking through and assessing their statements and expenses for everything from clothing to childcare to medical, so it’s important to ensure their spending is consistent and under control across the board for at least three months before applying for a loan.

Certain transactions that set off red flags for the banks and will most definitely harm the chances of their loan being approved include sports betting and the purchase of alcohol and lottery tickets.

2. Watch your credit card limits and pay on time

People with multiple credit cards and/or huge limits will find it harder to get their loan approved by the banks. It’s possible to reduce or close down cards altogether online, so advise them to set them at a reasonable limit before jumping in head first.

Late credit card payments are also a huge turn-off for banks when it comes to loan applications. Most people have the money in their accounts but just forget to pay, and when banks see this come the time to review their application, they will see it that if they can’t pay a credit card bill, they probably won’t be able to pay a home loan, either.

3. Save, save, save

It’s no secret: having money in the bank and putting money away regularly will impress the banks and prove your ability to pay back a loan repayment.

Applicants should aim to show that they’ve been saving the weekly equivalent to the value of their loan repayment, or paying rent plus putting savings aside to the equivalent of the repayment amount.

For example, if they’re currently paying $500 a week for rent and their loan repayment is going to be $700 a week, they should be putting $200 into a savings account every week for at least three months prior to applying.

4. Stable employment

This is something some applicants may find difficult, but that’s the harsh reality of the current situation. Holding permanent, stable employment is something the banks look favourably upon when deciding whether or not to approve a loan.

Moving jobs is ok if they’re moving to a better job with higher pay, but those jumping regularly from casual jobs will struggle to get approved.

5. Disclose all information

Disclosing all relevant information when applying for a home loan is important because if lenders uncover credit cards or other debts they weren’t initially forthcoming about, the banks may decline the loan on the spot due to non-disclosure. Being upfront is the best policy, and will help the application proceed more smoothly.